This blog about professional beards was originally published in April 2015 and remains one of The Alexander Group’s most-read blogs.

Professional beards are back and in a big way. The past few years have seen a significant upturn in the number of men wearing their facial hair “loud and proud,” both inside and outside of the office – a trend spanning industry, age, and even socioeconomic groups – leading to the inevitable question: “To beard or not to beard?”

Many of the world’s business leaders are sporting facial hair. Beards for professionals grace the faces of

- Sundar Pichai, CEO of Google and Alphabet

- Reed Hastings, Co-founder and Executive Chairman of Netflix

- Matt Parker, Executive Chairman of Nike

- Dara Khosrowshahi, CEO of Uber

- Larry Ellison, Co-founder, executive chairman, and CTO of Oracle

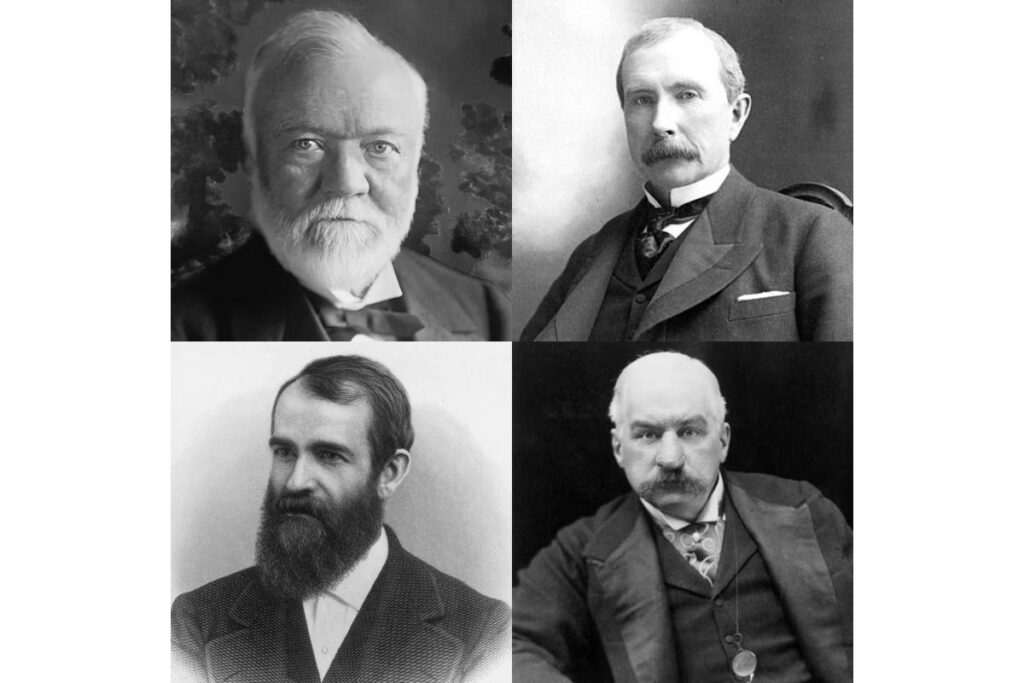

The newspaper’s front page hasn’t been this hirsute since Carnegie, Rockefeller, Gould, Morgan, and other captains of industry were shaping the economy.

The Shaving Razor Market: Trends and Growth Outlook

The shaving razor industry has seen modest growth, with U.S. revenue reaching $2.9 billion in 2025 at a 1.0% CAGR. In Europe, the market is projected to hit $6.67 billion, growing 1.16% annually. While the industry declined around 2015, demand has stabilized as consumers embrace premium and sustainable grooming products.

This shift reflects a broader trend—the changing role of facial hair in professional settings as beards become more accepted. Whether maintaining a beard or a clean shave, grooming choices now hold greater significance in personal and professional branding.

Professional Beards, Business, and Changing Perceptions

What has led to this dramatic change? Facial hair and capitalism have a connected history. Beards were once considered an indicator of liberal, anti-establishment views and dissident tendencies, championed by men like Karl Marx and Friedrich Engels, Che Guevara, and Fidel Castro.

However, not since the Robber Barons have professional beards been as popular in conservative, capitalist boardrooms as they are today. The hirsute look is currently not tied to any threatening economic or political ideology, and according to The New York Times, whiskers “no longer code as a threat.”

How Recession and Innovation Reshaped Grooming Trends

One interesting hypothesis is that many professionals began growing beards due to the recession of 2007-09. Christina Binkley of The Wall Street Journal describes two financial services professionals who lost their jobs and stopped shaving. She also points out that Al Gore grew a beard after losing the presidential election in 2000, stating that “it’s one of those tiny luxuries unleashed by unemployment.”

A significant contribution to the growing popularity of scruff comes from the technology industry.

The tech industry’s relaxed culture prioritizes innovation over strict dress codes, making facial hair widely accepted. Unlike traditional corporate environments, tech leaders are valued for their ideas rather than their grooming standards. This emphasis on creativity and individuality has helped normalize beards in professional settings.

The Alexander Group Managing Director John Lamar comments, “I went through a beard phase about 20 years ago. Okay, it was a goatee and not a very good one at that…I guess that was all I could muster.”

He continues, “I still like to go unshaven over the weekend…the rebel in me has not quite died. But come Monday morning, I break out the ol’ razor.” Lamar believes that the resurgence of professional beards has a lot to do with celebrities and techies. “The laid-back culture coupled with explosive wealth in these two worlds has created an “I just don’t care” attitude.”

According to a 2013 article in Daily Mail Reporter, men with beards “look as much as eight years older than their unshaven counterparts.” The late Steve Jobs of Apple is perhaps the epitome of how the image of the CEO has changed over the years.

In 2025, societal perceptions have evolved significantly. Beards have become mainstream and are widely accepted across various professional settings, reshaping perceptions of beards in the workplace.

A notable example is the New York Yankees, who, in February 2025, lifted their 49-year-old ban on beards to align with modern grooming trends and appeal to a broader pool of talent. This shift reflects a broader cultural acceptance of facial hair, with beards now often seen as expressions of individuality and personal style rather than indicators of age or non-conformity.

Beard of Directors

Despite the growing popularity of professional beards for businessmen, the number of unshaven business executives remains relatively small.

The Alexander Group Managing Director Beth Ehrgott has only had one client with a beard in all her years of search, but says, “It seems strange to think that beards still seem out of place in corporate America, yet many companies all have diversity initiatives and programs.”

Sarah Mitchell, Associate Director in The Alexander Group’s San Francisco office, says there is so much facial hair in the Bay Area that “it’s more of the rule than the exception. But I suppose I don’t see it very much when I think about those working in a more conservative corporate environment, as opposed to Google or one of the many startups.”

While personal expression is valued in the Bay Area in 2025, men’s style has shifted, with both long professional beards and a clean shave being acceptable—as long as grooming remains intentional. The choice between maintaining facial hair or a clean shave depends on personal style and industry norms, but the emphasis is always on a neat and professional presentation.

Phillip Rudolph, the former Executive Vice President, Chief Legal & Risk Officer, and Corporate Secretary at Jack in the Box, was fully bearded in 2007 when he was interviewed and then hired at Jack in the Box. At the time, he did not believe beards “are even remotely disqualifying.”

However, before joining Jack in the Box, Rudolph was Vice President and Deputy General Counsel at McDonald’s. He explains that while interviewing for the position, the human resources executive “asked how attached I was to my beard. I noted to him that, more correctly put, the beard was attached to me.”

Rudolph continued, “But I took the hint and shaved off the beard. I remained clean-shaven throughout my five years with McDonald’s.” Perhaps geography plays a role. Jack in the Box is headquartered in San Diego, and McDonald’s home is in Chicago.

A recruiter for Shell Oil Company says that she rarely sees candidates with facial hair, and hirsute executives at Shell “are few and far between.”

A Hairy Decision on Professional Beards

The bottom line is that if you are going to go unshaven, there are certain written and unwritten rules to follow.

- Know your company’s culture and whether or not there are regulations or unwritten “rules” concerning facial hair. Do your homework, or ask your manager.

- If you are going to grow facial hair, make sure that it is trimmed and neat. The last thing any executive (perhaps outside of the creative arts) wants to see is something ill-groomed and distracting.

- If you are interviewing, it is always better to play it safe. Research the industry and company. If in doubt, shave! You can always grow it back.

- Finally, if you decide to grow facial hair, plan accordingly. Wait for a holiday or vacation for ample time for proper growth. Stubble tends to be perceived as sloppy or lazy.

John Lamar sums it up perfectly: “For me, it basically boils down to the corporate culture. There are places where ping-pong, beards, and tattoos are completely acceptable and places where they are not. Having interviewed thousands of executives in various corporate cultures, I subscribe to one simple rule regarding facial hair – just keep it neat and clean.”

“A big bushy beard that could potentially house a family of robins says to me you don’t care about your appearance or how others may perceive you. That doesn’t bode well for a future leader.”

Know Your Audience

The professional beard has evolved from a symbol of rebellion to an accepted, albeit still debated, element of executive style. While beards are more common in tech and creative industries, traditional corporate environments still lean toward a clean-shaven look.

So, whether you prefer a clean-shaven look or professional men with beards aesthetic, understanding your industry’s expectations is key.

Whether interviewing for a new role or leading a boardroom, facial hair should align with your industry’s expectations and be well-maintained.

If you’re navigating executive hiring decisions—or considering how personal presentation affects career progression—The Alexander Group can help. Our expertise in executive search ensures leaders are not just a cultural fit but a strategic asset to their organizations. Connect with us today to explore how we can help shape your leadership team for success.