The Alexander Group, recognized as one of the country’s top CEO executive search firms, presents “Five Questions With Extraordinary Leaders,” our interview series with visionary industry leaders. In this installment, Managing Director and Chief Client Officer Amanda K. Brady interviews Carly Caulfield, Race Director and General Manager of the Houston Marathon Committee, discussing management style, the evolution of the annual event, and the ephemeral nature of creating a marathon.

It’s not a stretch to describe Carly Caulfield’s career as a marathon, not a sprint.

As the longest-tenured Houston Marathon Committee employee on staff, Caulfield started with the organization at 19 years old, and over the next 25 years, the Chevron Houston Marathon grew to one of the nation’s premier multi-race running events.

She serves as Race Director and General Manager of the Houston Marathon Committee, an executive leadership role Caulfield knows from sneakers up.

Her early years with the marathon were lessons in on-the-spot training. She quickly ascended from office clerk to more senior roles and, in 2020, was promoted to her current position.

Caulfield is the marathon’s first female race director and won the Industry Leader Under 40 Award from the National Center for Sports Safety and Security (NCS4) in 2016. She currently serves on the NCS4 Advisory Committee. In June 2019, the world running Association of International Marathons and Distance Races (AIMS) named Caulfield as a founding member of the AIMS Sustainability Commission.

Caulfield earned a Bachelor of Business Administration from the University of Houston – Downtown and an Executive MBA program at the University of Houston’s Bauer College of Business.

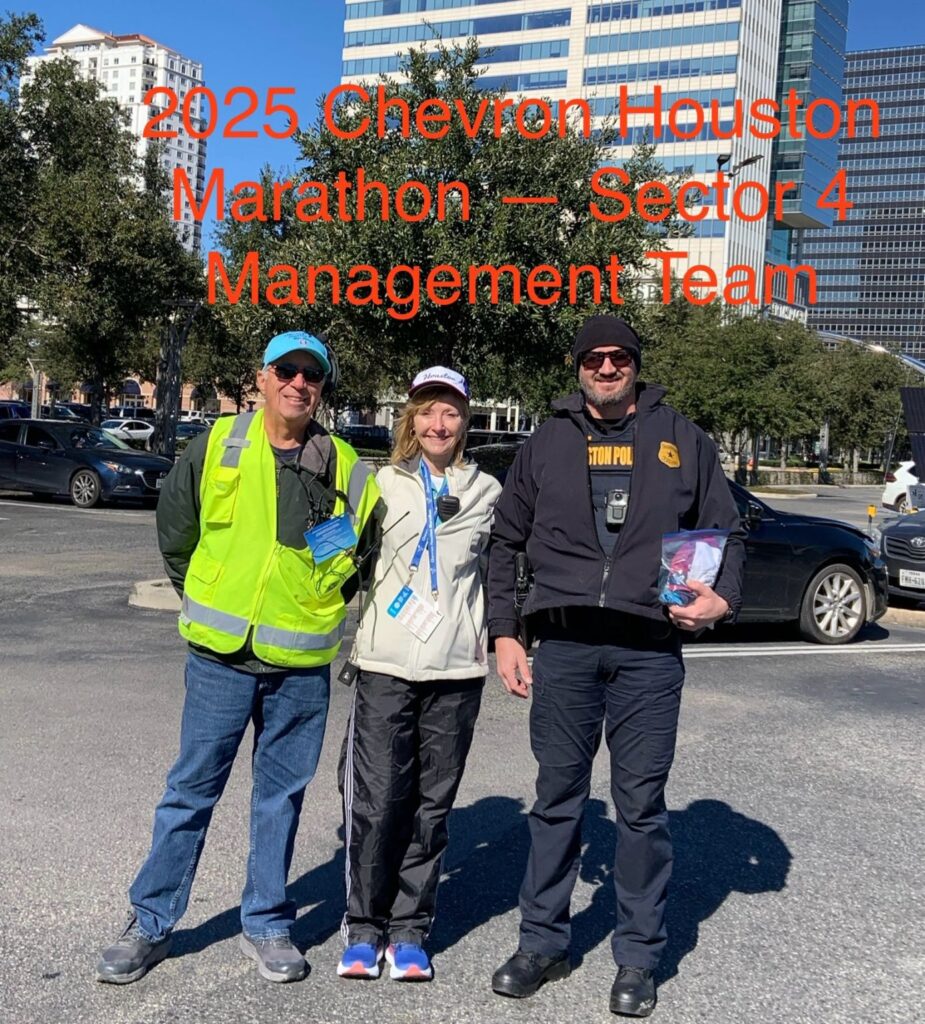

Managing Director and Chief Client Officer Amanda K. Brady immediately knew Caulfield would be a perfect fit for our ongoing series “Five Questions With Extraordinary Leaders” because she’s seen firsthand how Caulfield leads before, during, and after the marathon.

Brady serves as Sector 4 Captain, enlisting and working with volunteers while coordinating with the Houston Police Department to keep runners, volunteers, and spectators safe throughout the race.

Read on to learn more about Caulfield, her mentors and how collaboration is key to achieving successful outcomes.

Q: You have been with the Houston Marathon for 25 years. How did you get into the marathon industry?

A: By accident. I was a 19-year-old kid. I was introduced to a board member of the Houston Marathon when they were looking for an office clerk; the job paid more than I was making at the time.

I don’t recall wanting to pursue a specific career as a child, like a firefighter or a veterinarian. Around age 10 or 12, I read a book about a family with a lot of kids – I’m the oldest of six – and the parents were efficiency managers, and they practiced efficiency in their family. I read that book and thought, “That is what I want to be when I grow up, an efficiency manager.” I’m incredibly lucky to have fallen into this job, because every day I get to be the efficiency manager I dreamed of when I was a kid, and I love it.

Q: How did you learn how to manage people? Were you trained, or did it come naturally? Has your management style changed over the last decade as the organization grew?

A: I wasn’t trained to manage people, and I don’t think it comes naturally, but I have learned a lot through experience and through making mistakes. I’m lucky in that when I was hired, we only had two employees. We used to be almost entirely volunteer-managed, with one employee to sell sponsorships and someone else – me – to answer the phone and man the fax machine. As volunteers stepped down or retired, I thought, “Oh, my gosh, I could do that.”

First was registration, then volunteer coordinator, then charity coordinator. Eventually, it got to be too much. There’s only so many things you can do. I was 22 years old. I didn’t know you were allowed to ask for help, but I finally did. That is how the staff has grown over the years. I kept taking on a new job, and we kept hiring someone else to do the job I used to do.

I’m incredibly lucky that no one has ever had my job before. So, no one ever says to me, “Well, Amanda used to do it that way.” No one’s ever done it before, and that’s an incredible source of freedom and power. I never had anyone to train me, but that also meant I had to learn many lessons the hard way. Maybe the first five or eight years, when we had emergencies – we still do –I got to swoop in and be a hero for those emergencies, and it felt great.

Eventually, I matured or grew up enough to realize that was a ridiculous way to manage things. My greatest aspiration as the Race Director of the Houston Marathon is not to be needed, and it is what I ask of my team. “You guys develop your teams enough so that if something happens to you, you get sick, get hit by a truck, you don’t need to be there,” that is my goal every year. I have a great team, and I’m proud that everyone on the OPS team has been around for more than five years. Many of them six or seven.

My management style has certainly developed over the last 25 years. I believe in getting great people, giving them what they need, and then getting out of the way. That is my entire philosophy of management. And that comes from the fact that no one was in my way. I was making my own way.

But I should add that the marathon community is an amazing community. There is no one I know in this industry that I can’t call and ask, “How do you deal with this? Will you loan me that? Can you send me this document?” It is amazingly collaborative.

Q: You also manage a large group of volunteers. What are the challenges of managing such a large volunteer group, and how is that different from managing employees?

A: First, we couldn’t put on this event without our 5,000-plus volunteers. Volunteers have very different motivations from staff members. I love this event, but I also work to pay my mortgage. That’s not why our volunteers are part of the event, and I think volunteers, especially our Marathon Committee leadership, want to make a difference in the community. They want to solve problems. They want to feel valued. And it’s my and my team’s job to give volunteers the tools they need to feel that way.

I don’t personally manage volunteers anymore. It is still my job to connect with our volunteers and make sure they have what they need to succeed in the important roles they play in the marathon’s success every year.

From Left to Right:

Carly Caulfield, with her mom Mitzie Caulfield and sisters Bonnie and Betsy Caulfield, at the start of the Houston Marathon.

Q: Who are your mentors and guide stars? Why them?

A: First is my mom. My mom is a bad***. She is a go-getter. I’m not a runner. But I understood running when my mom started running. She had never run a marathon, but she started training so she could go run “Carly’s Marathon.” She would talk to me every day about her training and that’s when I started to understand what it meant for people to train—putting in the miles, trying to avoid an injury, the nutrition, and just getting to the finish line. This is not a football game. You don’t buy a ticket to the marathon and attend it. It’s not about what you paid for your registration. It is about what you have paid in your life to get to this place. I didn’t understand that until my mom started running. But once she did, I understood that every marathoner and participant who called with a problem needed our attention. It was like solving problems for my mom. If my mom had a problem, I would go to the end of the earth to fix it. And we still do that. That is our guiding philosophy. We have rules. We can’t accommodate everything, but if we have made a mistake, we will fix it for you. I care so deeply about the participant experience because when I think about it, it’s my mom’s marathon. My family is out there running and volunteering. I hope that we treat every runner just like I would treat my family.

The other person I would mention is Eric Berger with Space City Weather. He keeps us calm during weather emergencies. Their tagline is “no hype.” Just, “Here’s what’s happening. Here’s what we know. Here’s what we don’t know.” When I’m planning a marathon, I need to know what to expect, and Eric does that for me and many others across Houston.

Q: What is the hardest part about serving as Race Director and General Manager of the Houston Marathon. Does any year stand out as particularly challenging, and if so, why?

A: We are setting up for an event out of nothing in a few hours. You go to a football game in a stadium, you go to a show in the theater. Those are permanent venues. I think what’s unique about endurance sports is that we are building an entire event site out of thin air for just a moment. And then it goes away. So, every year has its unique challenges. Regardless of the challenges, our runners are investing their life in completing this event and we need to honor what these runners have invested in.

As for a year that sticks out, I would mention two. The one that just happened in January 2025. I’m still really tired. There was a lot of stress and a lot of extra planning because of what happened in New Orleans on New Year’s Eve.

Another was the Olympic trials in 2012. That definitely was a challenging year. Very proud of doing it. It was the first time the men and women had ever been hosted at the same time in the same place, and we went for it. We wanted to do something new and good for the sport and the city, and we did it.

It was on Saturday morning before the marathon the next day. None of our signage was the same as the marathon signage. Everything had to be the Olympics and NBC and USATF. We set up the event, held the trials, and then we had to tear down that entire event across the city and, the next morning, stand up our normal marathon event with all those sponsors and that special signage. It was nuts. But it put Houston on the map for Elite Racing. “We had two American records here just this past January, and a history of record-breaking performances for many years. Our race is watched nationally and internationally, and that just wasn’t the case in 2000 when I started. We were just a local event with 7,000 runners, and now we are on the international stage with more than 35,000 runners.